推薦15個最佳在線英文書庫

本名單所列的在線書庫是本人經常翻閱查考的網站,各有其優越之處,更重要的是多數書庫的圖書製作都相當精美,所收圖書有很多還是善本,這也是我想向大家推薦的理由之一。

1. http://onlinebooks.library.upenn.edu

喜歡讀英文書的朋友差不多都知道這個在線書庫,該書庫幾乎每天都有新書增加進來,目前其所擁有的在線免費圖書已超過2萬本,內容涉及眾多領域,閱讀格式也多種多樣。最好的是,你可以通過每本書所提供的鏈接,還能順籐摸瓜地找到其他很多非常有價值的在線書庫和豐富多彩的內容。本文所提供的其他一些書庫就是本人通過這一書庫的線索找到的。

2. http://www.hti.umich.edu/m/moa/

Making of America(MOA)是研究美國從南北戰爭到重建時期社會、歷史、文化的極佳的網上資源,當然其收藏內容遠不止於此,歐洲各國的歷史以及著名作家的經典著作也非常之多,比如英國湖畔派詩人的全集、休謨的英國史(6卷本)、基佐的法國文明史(8卷本)等等,而且所有圖書皆為圖形格式或PDF格式,並且都是掃瞄輸入的,原汁原味。遺憾的是,出於版權保護的考慮,所收圖書的作者差不多都是已故距今至少70年以上的。其中很多書都有極高的收藏價值。遺憾之處是其PDF格式不能整本下載。

3. http://posner.library.cmu.edu/Posner/

我個人要向大家極力推薦Posner先生的這個個人藏書網站,書籍的數量雖然不是很多,但每本差不多都是善本,甚至可能有孤本。比如他所收藏的莎士比亞戲劇集居然是第一個劇團演出本!吉本的《羅馬帝國興衰史》好像也是第一版的。所有圖書皆為原書掃瞄輸入,保留了這些善本書的全貌,非常值得藏書家收藏!缺點也跟MOA一樣,不能整本下載。

4. http://www.archive.org/details/texts

Internet Archive也是一個不錯的在線書庫,其中的百萬書庫項目(Million Book

Project)號稱到2005年底要將百萬冊圖書數字化,不過到目前為止該書庫好像只有1萬多本書,但這樣的成績也很不錯啦。其中的很多書都有DjVu、PDF版,也有不少好書,值得一看。

5. http://www.bartleby.com/

Bartleby.com敢號稱自己是「Great Books Online」當然有其理由,因為光它的「哈佛經典叢書」就多達100卷,哪位讀者要是能將其讀完,我看成為大師級人物應該不成問題。此外還有很多極有價值的百科全書和詞典,比如哥倫比亞百科全書(第六版)、美國文化遺產詞典、名人名言詞典等,所有的辭彙還都帶發音,相當不錯。

6.http://etext.lib.virginia.edu/

這是美國弗吉尼亞大學的電子圖書中心,你要是只看其書庫分類目錄,你肯定會怦然心動,感覺這個中心簡直是一個寶庫,然而遺憾的是,其中很多的東東只限於該校師生訪問,並不對外。但是其對外的部分也算不錯了,值得好好淘一淘。

7.http://selfknowledge.com/index.shtml

這個經典作家書庫收集的作家和書籍頗為不少,但大多以文學為主。值得一提的是它配有百科辭典功能,每本書中的很多詞彙都可鏈接到辭書中,讀者可聽到該詞的正規發音以及釋義,有些書還有真人閱讀片斷,實為外語學習的好幫手。

8.http://socserv.mcmaster.ca/econ/ugcm/3ll3/

McMaster大學的經濟思想史書庫,所收集的經濟學家著作相當齊全,實為研究經濟學的不可多得的好網站。當然,其藏書也並非全跟經濟學有關,比如也亞里士多德、孟德斯糾、伯克等人的著作。

9.http://oll.libertyfund.org/Home3/index.php

這是自由基金會組織建立的在線書庫,經常更新,而且差不多都是經典著作,涵蓋了社會政治、哲學、經濟、歷史等多領域的著作,很多著作還是掃瞄輸入的PDF版,比如吉本的12卷本《羅馬帝國興衰史》就是原書複印的,而且可以全書下載。此外像格拉斯哥版的亞當·斯密全集據說也是斯密最好的版本。

10.http://texts.cdlib.org/ucpress/

加州大學的這個學者文庫相當不錯,很多書都是非常新的著作,製作也相當不錯。遺憾的是也分成了對內和對外兩類,好在對外的數百本書也都是不錯的專著,值得好好讀。其中關於中國社會、歷史、經濟、文化方面的書也不少,其中有一本論述達賴喇嘛的書,很值得一讀。

11.http://www.perseus.tufts.edu/

帕修斯數字圖書館是研究西方古典著作的最佳網站,幾乎所有目前遺存的古希臘和古羅馬經典都能在此找到,很多書都有希臘文、拉丁文原本以及英文譯本,而且有希臘文和拉丁文詞彙研究工具,原文著作中的幾乎每一個詞都可以點擊察看其英文詞意以及使用頻率等。除此之外,該圖書館還有英國文藝復興時期書庫,有莎士比亞和馬洛的全部戲劇。

12.http://www.gutenberg.org/catalog/

古登堡項目可以說是目前全球最大的免費在線圖書網站,有很多書庫,包括上面的一些書庫都收藏有古登堡的圖書。雖然其中的大多數書籍都是TXT格式的,但也有一部分書製作還算不錯,比如愛德蒙·伯克的12卷本全集、帶有著名畫家達利插圖的但丁《神曲》等,此外還有一些圖書的音頻資料。缺點是這個網站經常會上不去。

13.http://www.blackmask.com/page.php

這個網站收藏的圖書比較多,每本書也有很多格式,我個人推薦使用微軟的Reader格式。不過該網站的搜索功能不怎麼樣,其他方面還算不錯。

14.http://gallica.bnf.fr/

這是全球互聯網上大概最齊全的法語圖書資源庫了,也是希拉克總統希望挑戰撒克遜語言在互聯網上統治地位的一個陣地。對法語愛好者來說這真是不可多得的寶庫,其中有巴爾扎克全集、波德萊爾全集……,還有很多中世紀的法語書籍和圖形資料,原版掃瞄,非常寶貴。

15.http://www.marxists.org/reference/subject/philosophy/index.htm

這是一個哲學書庫,雖然只有文本格式,但所收藏的書籍多為哲學史上的名著,從古代到當代都有,相當的豐富。

Understanding Volume & Open Interest in Commodity Futures

Volume represents the total amount of trading activity or contracts that have changed hands in a given commodity market for a single trading day. The greater the amount of trading during a market session the higher will be the trading volume. As mentioned earlier, a higher volume bar on the chart means that the trading activity was heavier for that day. Another way to look at this, is that the volume represents a measure of intensity or pressure behind a price trend. The greater the volume the more we can expect the existing trend to continue rather than reverse. Technicians believe that volume precedes price, meaning that the loss of upside price pressure in an uptrend or downside pressure in a downtrend will show up in the volume figures before presenting itself as a reversal in trend on the bar chart.

Open Interest is the total number of outstanding contracts that are held by market participants at the end of each day. Where volume measures the pressure or intensity behind a price trend, open interest measures the flow of money into the futures market. For each seller of a futures contract there must be a buyer of that contract. Thus a seller and a buyer combine to create only one contract. Therefore, to determine the total open interest for any given market we need only to know the totals from one side or the other, buyers or sellers, not the sum of both.

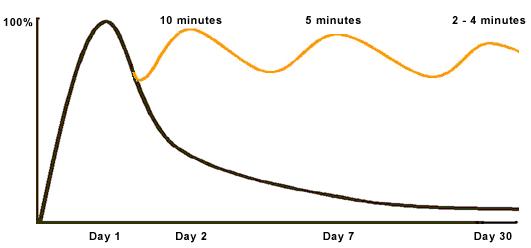

Each trade completed on the floor of a futures exchange has an impact upon the level of open interest for that day. For example, if both parties to the trade are initiating a new position ( one new buyer and one new seller), open interest will increase by one contract. If both traders are closing an existing or old position ( one old buyer and one old seller) open interest will decline by one contract. The third and final possibility is one old trader passing off his position to a new trader ( one old buyer sells to one new buyer). In this case the open interest will not change. By monitoring the changes in the open interest figures at the end of each trading day, some conclusions about the day activity can be drawn. Increasing open interest means that new money is flowing into the marketplace. The result will be that the present trend ( up, down or sideways) will continue. Declining open interest means that the market is liquidating and implies that the prevailing price trend is coming to an end. A knowledge of open interest can prove useful toward the end of major market moves. A levelling off of steadily increasing open interest following a sustained price advance is often an early warning of the end to an uptrending or bull market.

The relationship between the prevailing price trend, volume, and open interest can be summarized by the following table.

It is important to understand that the commodity price chart only records the data. In itself, it has little value. By monitoring the price trend, volume and open interest the technician is better able to gauge the buying or selling pressure behind market moves. This information can be used to confirm a price move or warn that a price move is not to be trusted. This will provide you with valuable information to develop a suitable pricing strategy and an appropriate production-marketing plan for your farming operation.